Special guest post by Tom Scrutton

Keeping records is extremely important for both business owner and taxpayers. The good news these days is that you can maintain soft copies of most of your historical records, saving on clutter and of course minimising tree destruction. Originals of some legal documents such as wills still need to be kept in physical form. Any documents transferred to digital or ‘soft’ form must be a true and clear copy of the original. Backing up these digital files is extremely important to avoid loss of data and therefore non-compliance.

Generally, tax records for a particular year only need to be kept for a period of 5 years from the date that relevant tax return is lodged or a dispute with the ATO is resolved.

Any records relating to CGT assets such as properties or shares must be kept for the entire period these assets are owned plus 5 years after the date of the CGT event (i.e. sale of asset). This is not only to satisfy the ATO, but also to satisfy us as your accountant so we can be sure we are accounting for the correct cost base.

Company constitutions, board minutes and resolutions must be kept permanently.

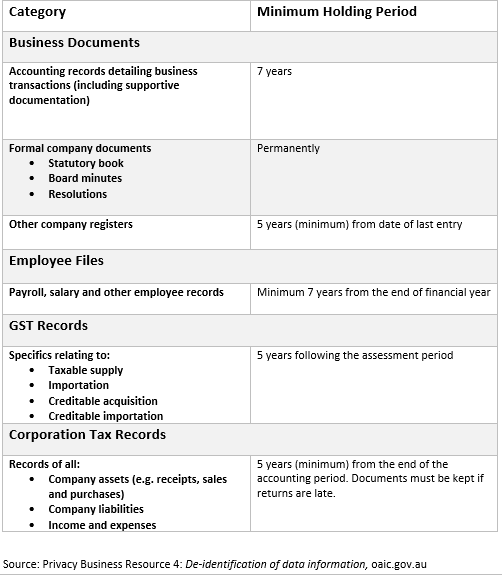

The following table gives a brief snapshot of what needs to be held and for how long. This is a general guideline and is not designed to constitute legal advice. Consult your lawyer or government agency for further clarification: