At Prime Partners we’re big fans of using the latest technology to make business as easy as possible. We started using Xero back in 2012 and have always practiced what we preach.

A product we’ve been using in our business to great effect is Receipt Bank. This is a receipt and expense processing system that is linked up to Xero.

What’s so great about Receipt Bank, is that it can automatically turn this:

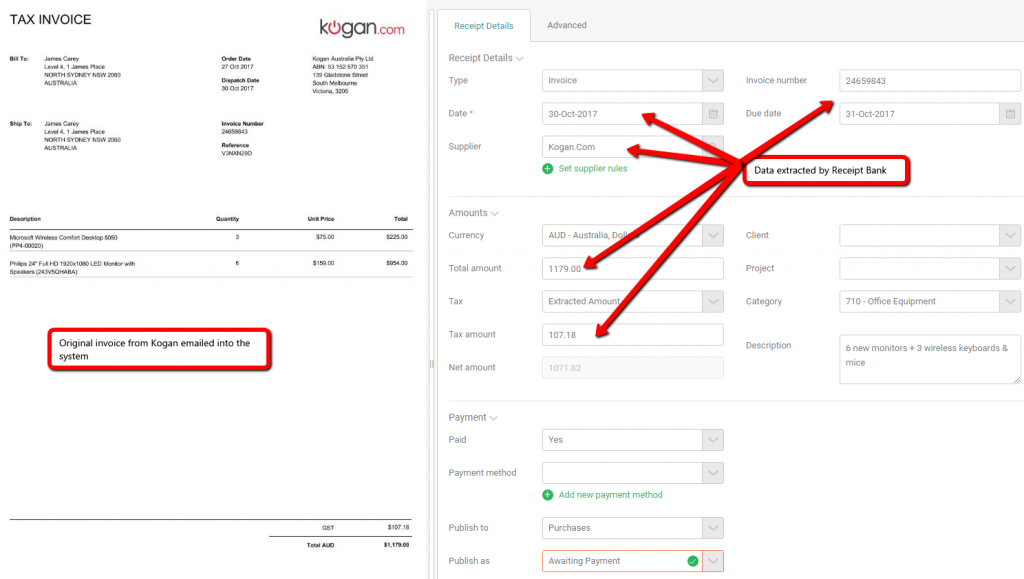

Into this:

(You don’t have to be an accounting nerd to appreciate this. Or maybe you do….)

How we use Receipt Bank:

1. Any invoice or receipt that Prime Partners received from a supplier goes directly into Receipt Bank via email or photo (on Receipt Bank app).

- For regular suppliers I either set up a rule in my email to automatically forward into Receipt Bank, or I give the supplier the unique email address so they can email directly to Receipt Bank.

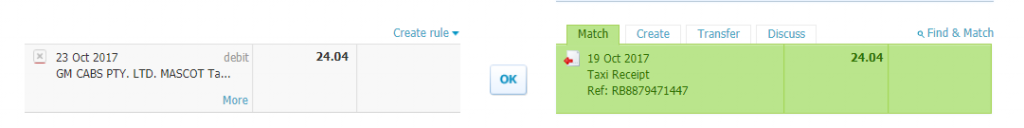

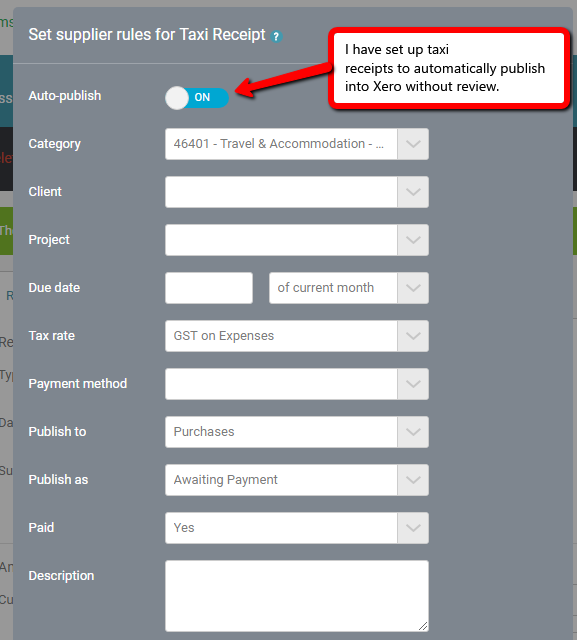

- For something like a taxi receipt or parking ticket, we take a photo of it using the Receipt Bank app.

2. Receipt Bank extracts the information from the receipt (supplier name, amount, GST etc).

3. This then gets published (manually with review, or automatically) to Xero as an accounts payable bill.

4. If the expense has already been paid it is simply a process of reconciling the relevant bank accounts.

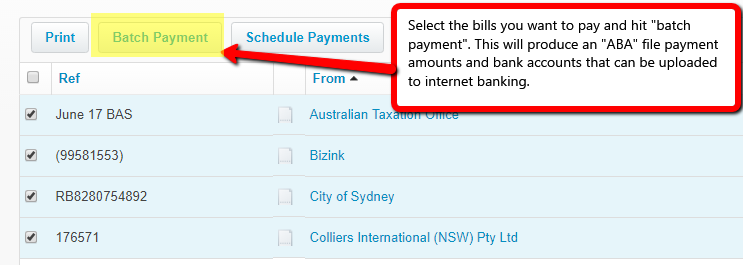

5. If it has not been paid, I schedule the payment using “Batch Payments”. I have set up all of my supplier bank account details in Xero’s Contacts module. The Batch Payment functionality produces what’s called an ABA file which can be uploaded to your internet banking to speed up payments and reduce the risk of manual error.

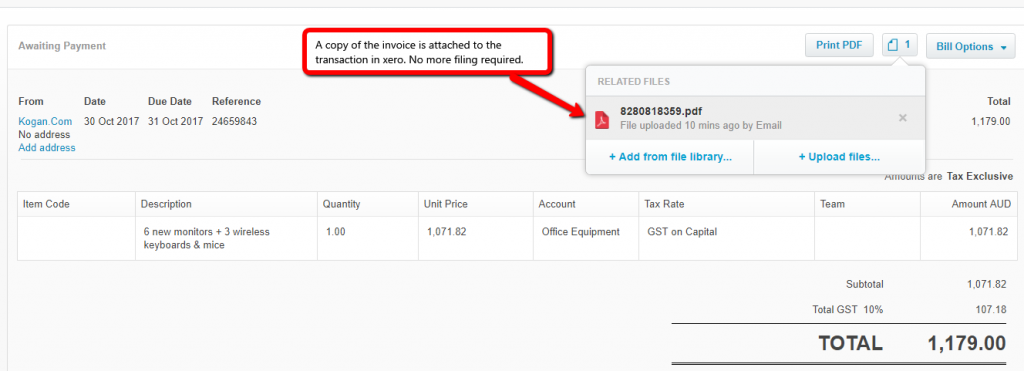

The best part of using Receipt bank in this way is not just the time saving which is significant, but it means that every single expense in our business has the proof (invoice / receipt) attached to the accounting transaction. No more paper files.

In the event we need to find a receipt for any purpose (ATO review, warranty claim etc), it is attached to the transaction in our accounting system.

How good is that!?