Our 2024 EOFY update and actions for Business will give you an overview of tax changes and some actions you can take to reduce your tax exposure and minimise risk of an audit.

Reducing your tax exposure, maximising the opportunities available to you, and reducing your risk of an audit by the regulators is in your best interests. With the end of the financial year fast approaching, this update will help you do exactly that

We want to help you achieve the best result for you and your business. If there is any additional information we can provide, or if we can assist you with your individual situation, please contact us today.

What’s New:

- In Brief

- Personal Income Tax Thresholds from 1 July 2024

- Superannuation Guarantee increases to 11.5%

- Small Business energy credit

- Instant write-off for depreciating assets in limbo

- $20,000 Small Business energy incentive also in limbo

- Skills and training boost

- Areas of ATO scrutiny

- Financial Housekeeping

- Top Tax Tips

- What we need from you – a general list of what to prepare before your next meeting with us

We want to help you achieve the best result. If there is any additional assistance we can provide, or if you would like us to review your situation, please call us on 02 8378 2421.

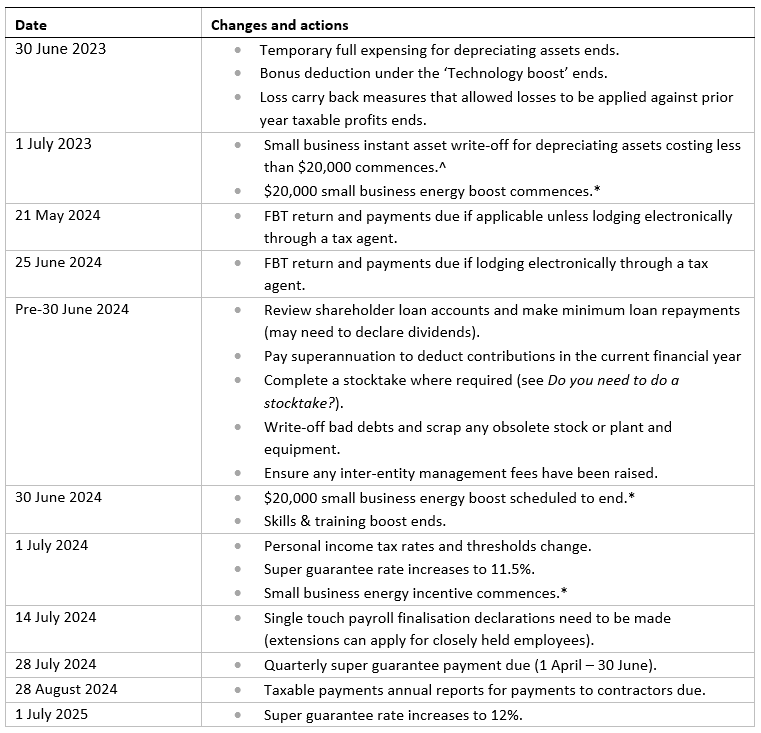

In Brief

*Subject to legislation. Not yet law.

^Parliamentary disagreement on whether to increase the threshold to $30,000 and apply to businesses with a group turnover of less than $50m. Also subject to legislation and not yet law.

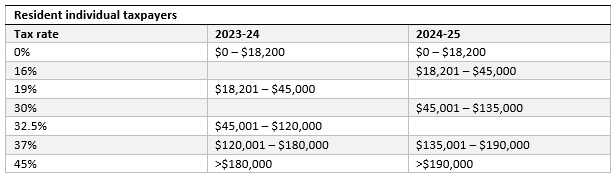

Personal Income Tax Thresholds from 1 July 2024

The personal income tax rates and thresholds will change from 1 July 2024. If your business is an employer, it will be important to ensure that your payroll systems are accurate including for any salary packaging arrangements with staff members.

For working holiday makers, the first $45,000 is taxed at 15%.

Superannuation Guarantee increases to 11.5%

The Superannuation Guarantee (SG) rate will rise from 11% to 11.5% on 1 July 2024 and will continue with a final increase to 12% on 1 July 2025.

If you are employed, what this will mean depends on the terms of your employment agreement. If your employment agreement states you are paid on a ‘total remuneration’ basis (base plus SG and any other allowances), then your take home pay might be reduced by 0.5%. That is, a greater percentage of your total remuneration will be directed to your superannuation fund. For those paid a rate plus superannuation, then your take home pay will remain the same, but your superannuation balance will benefit from the increase. If you are used to annual increases, the 0.5% increase might simply be absorbed into your remuneration review.

Small Business energy credit

Announced in the 2024-25 Federal Budget, from 1 July 2024, small businesses that meet the relevant State or Territory definition of a ‘small customer’ will receive a $325 rebate on energy bills. The definition is based on electricity consumption thresholds. Find out more at the energy.gov.au.

Instant write-off for depreciating assets in limbo

In the 2023-24 Federal Budget, the Government announced that small businesses with an aggregated turnover of less than $10 million will be able to immediately deduct the full cost of eligible depreciating assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. In the 2024-25 Federal Budget, the Government extended this measure to 30 June 2025.

Without these measures, the instant asset write-off threshold would be $1,000.

However, legislation to enact the 2023-24 measure has not passed Parliament due to disagreements between the Senate and House of Representatives on whether:

- To increase to the instant asset write-off cost limit to assets costing less than $30,000; and

- To expand the range of businesses able to access the instant asset write off to include those with an aggregated annual turnover of less than $50m.

As currently proposed, the increased threshold also applies to determine whether the full balance of the small business pool is written off in the 2024 income year.

This initiative is not yet law and we will keep you up to date on any progress.

$20,000 Small Business energy incentive also in limbo

The Small Business Energy Incentive, which provides an additional 20% deduction on the cost of eligible depreciating assets or improvements to existing depreciating assets that support electrification and more efficient use of energy, is not yet law. The legislation enabling the incentive is in the same Bill as the instant asset write-off measure.

The incentive was set to apply to eligible assets first used or installed ready for use, or the improvement costs incurred, between 1 July 2023 and 30 June 2024.

Up to $100,000 of total expenditure is expected to be eligible with a maximum bonus deduction of $20,000.

If enacted, the incentive will be available to small and medium businesses with an aggregated annual turnover of less than $50 million.

In terms of what types of assets are eligible, a new depreciating asset would broadly be eligible for the bonus deduction if:

- It uses electricity and there is a new reasonably comparable asset that uses a fossil fuel available in the market (e.g., the taxpayer chooses an electric asset over a gas / petrol powered asset);

- It uses electricity and is more energy efficient than the asset it is replacing or, if it is not a replacement, a new reasonably comparable asset available in the market (e.g., broadly, upgrading to a more energy efficient asset, or picking a more energy efficient new asset); or

- It is an energy storage, demand management or efficiency-improving asset.

Improvements to existing depreciating assets may also be eligible for the bonus deduction if they enable an asset to use electricity instead of fossil fuels, to be more energy efficient, or facilitate energy storage, demand management or monitoring.

Some exclusions will apply including electric vehicles, renewable electricity generation assets, capital works, and assets that are not connected to the electricity grid and use fossil fuels. Financing costs, including interest and borrowing expenses, are also excluded.

Eligible assets will need to be first used or installed ready for use, or the improvement costs incurred, between 1 July 2023 and 30 June 2024 to qualify for the bonus deduction.

This initiative is not yet law and we will keep you up to date on any progress.

Skills and Training boost

The ‘skills and training boost’ is available to businesses with an aggregated annual turnover of less than $50 million.

The skills and training boost provides a bonus deduction equal to 20% of eligible expenditure for external training provided to your workers. The additional deduction is available for expenditure incurred (registered) from 7:30pm (AEST) on 29 March 2022 until 30 June 2024.

Not all courses provided by training companies will qualify for the boost; only those charged by registered training providers within their registration. Typically, this is vocational training to learn a trade or courses that count towards a qualification rather than professional development.

Areas of ATO scrutiny

Profits of Professional Services firms

If your company operates a professional services firm, it is important to understand the implications of the ATO’s finalised guidance on profits of professional services firms.

The ATO takes a strong stance on how the profits of professional services firms are structured and how profits flow through to the professionals involved. The ATO is specifically concerned with structures designed to divert income so the professional ends up receiving very little income directly for their work, reducing their taxable income.

If these structures appear to be in place to divert income to create a tax benefit for the professional, Part IVA may apply. Part IVA is an integrity rule that allows the Commissioner to remove any tax benefit received by a taxpayer where they entered into an arrangement in a contrived manner in order to obtain a tax benefit. Part IVA may apply to schemes designed to ensure that the professional is not appropriately rewarded for the services they provide to the business, or that they receive a reward which is substantially less than the value of those services.

The ATO guidance sets out a series of tests to identify a practitioner’s risk level, looking at the structure of the business and how profits are distributed, and whether the structure has any high-risk features.

With the guidance finalised some time ago, the ATO has now been reaching out to taxpayers to review how they line up against its guidelines. For professional services firms, it is important to understand the risk level for each principal practitioner separately.

If you are concerned about your position, please contact us.

ATO focus on shareholder loans

Division 7A is an area of the tax law aimed at situations where a private company provides benefits to shareholders or their associates in the form of a loan, payment or by forgiving a debt. It can also apply where a trust has allocated income to a private company but has not actually paid it, and the trust has provided a payment or benefit to the company’s shareholder or their associate.

Division 7A was introduced to prevent shareholders accessing company profits or assets without paying the appropriate tax. If triggered, the recipient of the benefit is taken to have received a deemed unfranked dividend for tax purposes and taxed at their marginal tax rate. This unfavourable tax outcome can be prevented by:

- Paying back the amount before the company tax return is due (this is often done via a set-off arrangement involving franked dividends); or

- Putting in place a complying loan agreement between the borrower and the company with minimum annual repayments at the benchmark interest rate (8.27% for 2023-24). It’s essential that annual repayments are actually made at the correct benchmark interest rate.

A recent ATO review revealed a series of problem areas where taxpayers are getting it wrong:

- Incorrect accounting for the use of company assets by shareholders and their associates. Often, the amounts are not recognised;

- Loans made without complying loan agreements;

- Reborrowing from the private company to make repayments on Division 7A loans;

- The wrong interest rate applied to Division 7A loans (there is a set rate that must be used).

Non-compliance can lead to some very harsh tax outcomes. It’s important to identify and ensure Division 7A problems are correctly managed.

Financial Housekeeping

Having trouble with tax debt?

If you are having trouble paying your tax liability, please let us know as soon as possible so we can negotiate a deferral or payment plan with the ATO on your behalf.

Reporting payments to contractors

The taxable payments reporting system requires businesses in certain industries to report payments they make to contractors (individual and total for the year) to the ATO. ‘Payment’ means any form of consideration including non-cash benefits and constructive payments. Taxable payments reporting is required for:

- Building and construction services

- Cleaning services

- Courier and road freight services

- Information technology (IT) services

- Security, investigation or surveillance services

- Mixed services (providing one or more of the services listed above)

The annual report is due by 28 August 2024.

Director ID regime

The director ID regime prevents the use of false and fraudulent director identities.

While there was a transition phase to allow time for existing directors to obtain a director ID, this has now elapsed and all directors should have a director ID in place. Unregistered directors face criminal penalties of up to $16,500 and civil penalties of up to $ 1,375,000.

All incoming directors are required to obtain a director ID prior to their appointment as a director.

Before you roll-over your software…

Before rolling over your accounting software for the new financial year, make sure you:

- Prepare your financial year-end accounts. This way, any problems can be rectified and you have a ‘clean slate’ for the 2024-25 year. Once rolled over, the software cannot be amended.

- Do not finalise end of financial year payroll until you are sure that your STP finalisation declaration is correct. Always perform a payroll back-up before you roll over the year.

Employee Reporting

Single touch payroll

For payments to employees through single touch payroll (STP), a finalisation declaration generally needs to be made by 14 July 2024. However, there are some exceptions to this.

If your business has 20 or more employees and some of them are closely held employees (relatives for example), then the finalisation declaration for the closely held employees needs to be made by 30 September.

If your business has 19 or fewer employees and they are only closely held employees, the finalisation declaration should be made by the due date for lodgement of the tax return of the relevant employee.

Employees will be able to access their Income Statement through their myGov account.

Closely held payees

Payments to closely held payees can be reported through STP in one of three ways:

- Reporting actual payments in real time – reporting each payment to a closely held payee on or before each pay event (essentially using STP ‘as normal’).

- Reporting actual payments quarterly – lodging a quarterly STP statement detailing these payments for the quarter, with the statement due when the activity statement is due.

- Reporting a reasonable estimate quarterly – lodging a quarterly STP statement estimating reasonable year-to-date amounts paid to employees, with the statement due when the activity statement is due.

Small employers that have arm’s length employees must report STP information on or before each payday regardless of the method that is chosen for reporting payments to closely held payees.

If your business has closely held employees, it will be important to plan throughout the year to prevent problems occurring at year end.

Reportable Fringe Benefits

Where you have provided fringe benefits to your employees in excess of $2,000, you need to report the FBT grossed-up amount. This is referred to as a `Reportable Fringe Benefit Amount’ (RFBA).

Do you need to do a stocktake?

Businesses that buy and sell stock generally need to do a stocktake at the end of each financial year as the increase or decrease in the value of stock is included when calculating the taxable income of your business.

If your business has an aggregated turnover below $50 million, you can use the simplified trading stock rules. Under these rules, you can choose not to conduct a stocktake for tax purposes if the difference in value between the opening value of your trading stock and a reasonable estimate of the closing value of trading stock at the end of the income year is less than $5,000. You will need to record how you determined the value of trading stock on hand.

If you do need to complete a stocktake, you can choose one of three methods to value trading stock:

- Cost price – all costs connected with the stock including freight, customs duty, and if manufacturing, labour and materials, plus a portion of fixed and variable factory overheads, etc.

- Market selling value – the current value of the stock you sell in the normal course of business (but not at a reduced value when you are forced to sell it).

- Replacement value – the price of a substantially similar replacement item in a normal market on the last day of the income year.

A different basis can be chosen for each class of stock or for individual items within a particular class of stock. This provides an opportunity to minimise the trading stock adjustment at year-end. There is no need to use the same method every year; you can choose the most tax effective option each year. The most obvious example is where the stock can be valued below its purchase price because of market conditions or damage that has occurred to the stock. This should give rise to a deduction even though the loss has not yet been incurred.

Top Tax Tips

1. Declare dividends to pay any outstanding shareholder loan accounts

If your company has advanced funds to a shareholder or related party, paid expenses or allowed a shareholder or other related party to use assets owned by the company, then this can be treated as a taxable dividend. The regulators expect that top-up tax (if any applies) should be paid by shareholders at their marginal tax rate once they have access to these profits. When it comes to loans, a complying loan agreement can normally be used to prevent the full loan balance from being treated as a taxable dividend.

If you have any shareholder loan accounts from prior years that were placed under complying loan agreements, the minimum loan repayments need to be made by 30 June 2024. It may be necessary for the company to declare dividends before 30 June 2024 to make these loan repayments.

The tax rules in this area can be extraordinarily complex and can lead to some very harsh tax outcomes. It is important to talk to us as soon as possible if you think your company has made payments or advanced funds to shareholders or related parties.

2. Directors’ fees and employee bonuses

Any expected directors’ fees and employee bonuses may be deductible for the 2023-24 financial year if you have ‘definitely committed’ to the payment of a quantified amount by 30 June 2024, even if the fee or bonus is paid to the employee or director after 30 June 2024.

You would generally be definitely committed to the payment by year-end if the directors pass a properly authorised resolution to make the payment by year-end. The employer should also notify the employee of their entitlement to the payment or bonus before year-end.

The accrued directors’ fees and bonuses need to be paid within a reasonable time period after year-end.

3. Write-off bad debts

To be a bad debt, you need to have brought the income to account as assessable income and given up all attempts to recover the debt. It needs to be written off your debtors’ ledger by 30 June. If you don’t maintain a debtors’ ledger, a director’s minute confirming the write-off is a good idea.

4. Review your asset register and scrap any obsolete plant

Check to see if obsolete plant and equipment is sitting on your depreciation schedule. Rather than depreciating a small amount each year, if the plant has become obsolete, scrap it and write it off before 30 June. Small business entities can choose to pool their assets and claim one deduction for each pool. This means you only have to do one calculation for the pool rather than for each asset.

5. Bring forward repairs, consumables, trade gifts or donations

To claim a deduction for the 2023-24 financial year, consider paying for any required repairs, replenishing consumable supplies, trade gifts or donations before 30 June.

6. Pay June quarter employee super contributions now

Pay June quarter super contributions this financial year if you want to claim a tax deduction in the current year. The next quarterly superannuation guarantee payment is due on 28 July 2024. However, some employers choose to make the payment early to bring forward the tax deduction instead of waiting another 12 months.

Don’t forget yourself. Superannuation can be a great way to get tax relief and still build your personal wealth. Your personal or company sponsored contributions need to be received by the fund before 30 June to be deductible.

7. Realise any capital losses and reduce gains

Neutralise the tax effect of any capital gains you have made during the year by realising any capital losses – that is, sell the asset and lock in the capital loss. These need to be genuine transactions to be effective for tax purposes.

8. Raise management fees between entities by June 30

Where management fees are charged between related entities, make sure that the charges have been raised by 30 June. Where management charges are made, make sure they are commercially reasonable and documentation is in place to support the transactions. If any transactions are undertaken with international related parties, then the transfer pricing rules need to be considered and the ATO’s documentation expectations will be much greater. This is an area under increased scrutiny.

What We Need From You

This is a general list of what we need to complete your fund’s tax and accounting requirements.

- Accounts data file access (MYOB, Quickbooks, Xero, etc.,)

- Debtors & creditors reconciliation

- Stocktake if applicable (or if your business is a Small Business Entity, use the simplified trading stock rules mentioned above)

- 30 June bank statements on all relevant loan documents

- Documents on new assets bought or sold, including the date you entered the contract and the date the asset was first used or installed ready for use

- Documents supporting the sale or improvement of assets that are energy efficient

- Education and training expenses

- Details of any grants or disaster loans received

- Details of any insurance payouts for your business or business premises

- Payroll reconciliation

- Superannuation reconciliation

- Cash book (if applicable)

- Details of any transactions involving cryptocurrency (e.g., Bitcoin, NFTs)

- 30 June statements on any investment or operating accounts

And, if we are preparing your individual income tax return:

- Work from home diary

- Electric car details

- Income Statement

- Tax statements of managed investment funds

- Interest income from banks and building societies

- Dividend statements for dividends received

- For share sales or purchases, the purchase and sale contract notes

- For real estate sales or purchases, the solicitor’s correspondence for the purchase and sale

- Rental property statements from real estate agent and details of other expenditure incurred

- Work related expenses

- Self-education expenses

- Travel expenses

- Donations to charities

- Health insurance and rebate entitlement

- Family Tax Benefits received

- Commonwealth assistance notices

- IAS statements or details of PAYG Instalments paid

- Details of any transactions involving cryptocurrency (e.g., Bitcoin, NFTs)

- Details of any income derived from participating in the sharing economy (e.g., Uber driving, rent from AirBNB, jobs completed through Airtasker etc.,)